Disability Insurance Guide for Physicians

By: Jerry C. Thomas, CFP®

Our Disability Insurance Guide for Physicians is here to help you understand the ins and outs of disability insurance planning. We know you got a lot on your plate between your 80-hour-a-week shifts, studying for boards, interviewing for a fellowship, and trying to manage your practically non-existent personal life.

Disability insurance is an essential factor in your overall financial well-being. It's the building block of a solid financial plan.

Doctors spend years developing the skills and knowledge they need to create a career, and losing those abilities is a huge financial risk. Disability insurance is even more important when saving up an emergency fund is not an option—and it may not be for many doctors.

Here, we walk through some need-to-know information about disability insurance for physicians. We answer some of your most pressing questions and give you the information you may not have even known you needed.

Disability Stats

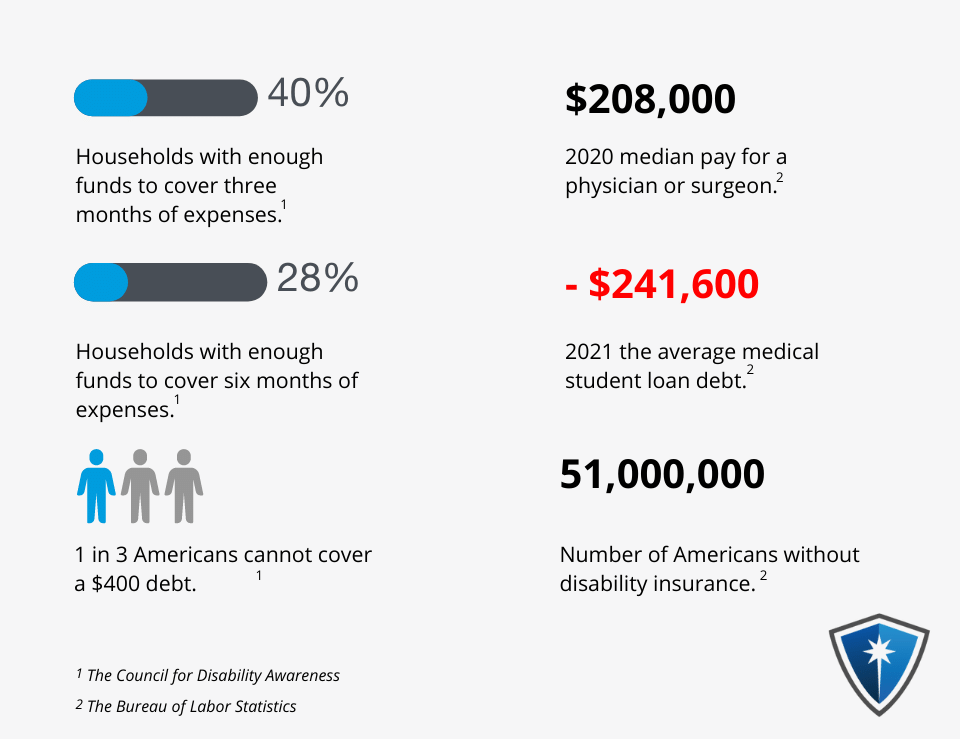

The Council for Disability Awareness reports that only 40 percent of US households have enough funds in the bank to cover three months of expenses. However, only 28 percent can cover six months of expenses.

In fact, three out of ten Americans cannot cover a $400 bill without borrowing the money. When you also consider that 51 million Americans do not have disability insurance, these statistics are scary—it means that if they are injured, they have no way to pay for their regular expenses.

Professionals, like doctors, have unique needs when it comes to disability insurance. Many doctors have high incomes but also high expenses. The Bureau of Labor Statistics reports that, as of 2020, the median pay for a physician or surgeon was roughly $208,000 annually.

As of December 2021, the average medical student graduates with $241,600 in student loan debt. For many doctors, a sudden disability might lead to defaulting on their loans and falling way behind on their regular bills.

What is disability insurance?

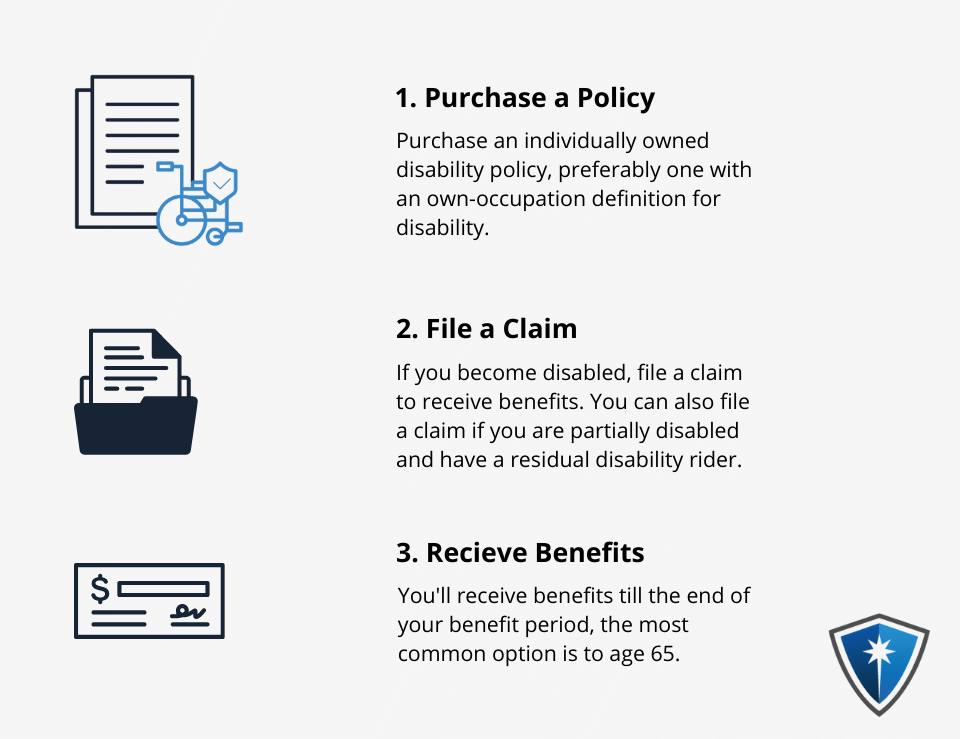

Disability insurance provides replacement income if you suddenly find yourself unable to work because of an injury or illness. If you become disabled, your disability insurance policy provides a set amount of funds every month for a specific period of time.

That amount of time can be a certain term, such as a matter of months or years, or it can continue until you are no longer considered disabled. The amount and number of payments you can receive will vary based on your policy.

How does disability insurance work?

What does disability insurance cover?

Disability insurance replaces a percentage of your income while you are disabled and unable to work. It does not cover medical expenses or any other bill you might face because of your disability—it focuses only on income replacement. That money can be used for anything you might need, including regular bills and household expenses.

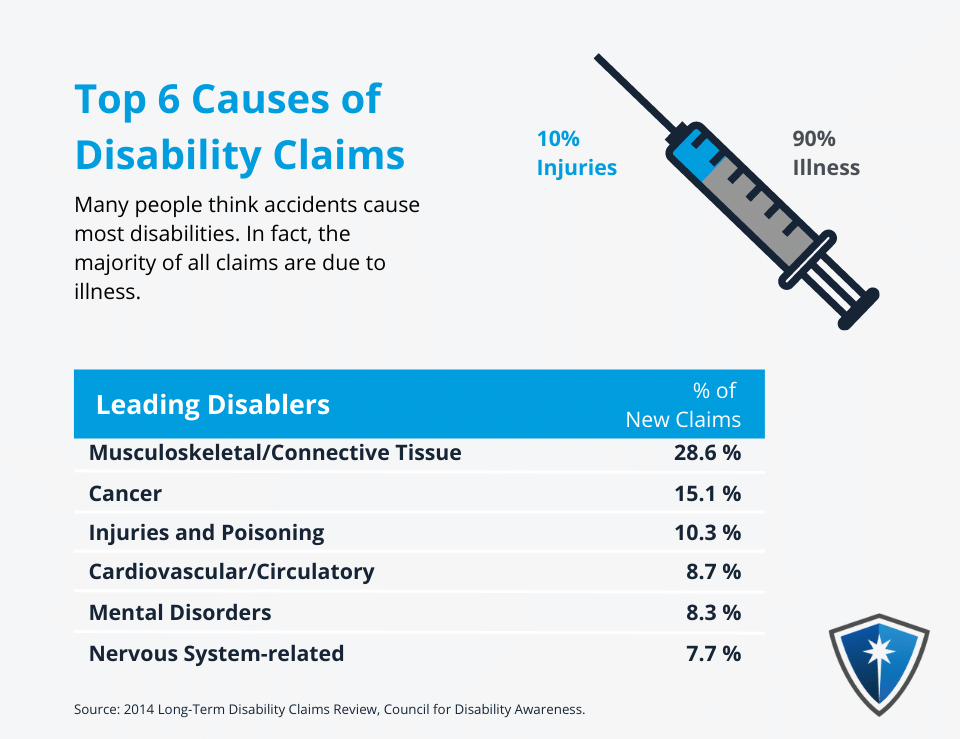

Examples of events that might trigger disability insurance include:

- Cancer

- Heart attack

- Physical injuries

- Parkinson's Disease

- Respiratory disorders

- Musculoskeletal system disorders

- Mood and physiological disorders

- Intellectual disabilities

The amount of money you receive through your disability insurance policy will vary based on the specific terms of your policy.

In most cases, the amount of your benefits does not depend on the type of disability you have. Therefore, you only need to be considered "disabled" based on the definition in your policy for benefits to start.

Why should a doctor buy disability insurance?

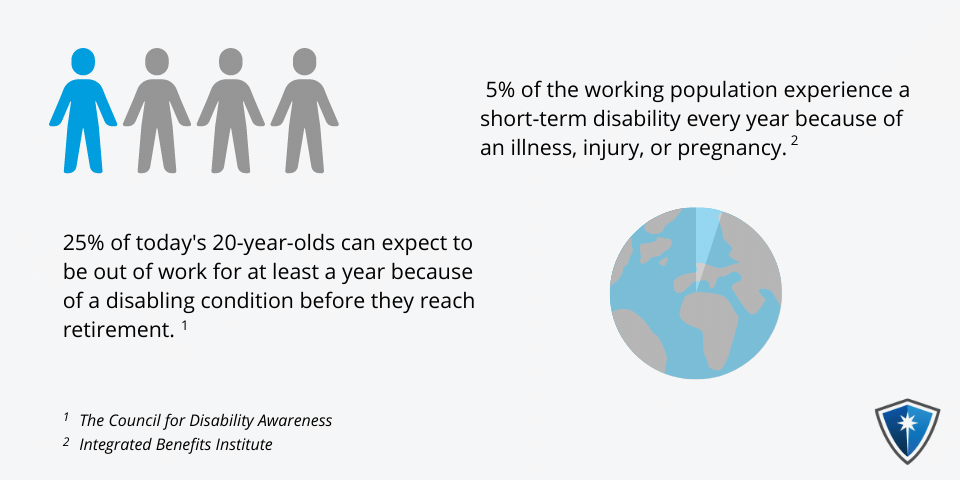

The likelihood that you develop a disabling condition that limits your ability to work is higher than you might think.

The Social Security Administration has reported that roughly 25% of today's 20-year-olds can expect to be out of work for at least a year because of a disabling condition before they reach retirement.

About 5% of the working population experience a short-term disability every year because of an illness, injury, or pregnancy.

Although these statistics are general, they are especially concerning for doctors, who often have high debt loads because of medical school.

Roughly one in seven doctors will become disabled at some point in their careers.

If you suddenly cannot work, do you have a plan for how you will address household expenses and debt payments?

Disability insurance provides a good stop-gap measure when you do not have the savings to address a short-term disability. It also provides a fallback in the event of a long-term disability. Ultimately, disability insurance for doctors provides peace of mind if an illness or injury causes a disability.

When should a doctor buy disability insurance?

There is really no wrong time to purchase disability insurance, but the sooner, the better. The healthier and younger you are, the easier it will be to qualify for a policy (both long-term and short-term policies). As you age, the premiums will increase, and if your health deteriorates, the premiums will likely rise as well.

That means that getting disability insurance (and keeping it) at the start of your career is a good idea. This time period is also often when doctors have the highest debt load from medical school as well, so having that income replacement is especially important.

Which companies sell disability insurance for doctors?

- Ameritas, Guardian, Mass Mutual, Ohio National, Principal Financial, The Standard.

Why does your "disability definition" matter as a doctor?

To receive benefits for a disability, you have to meet the definition of "disabled." You may assume that if you cannot work, you are automatically disabled, but that is often not the case in most disability insurance policies.

The definition of disability is even more important for doctors. In general, being a doctor does not require the same level of physical strength or movement that would be required in a labor-based occupation (like welding, carpentry, or even working in a factory).

As a result, the injury that causes a doctor to be unable to work is likely going to look very different compared to an injury that would cause a blue-collar employee to be unable to work. In some situations, that can mean that qualifying for disability benefits can be harder, especially if you get disability insurance that is not geared toward doctors.

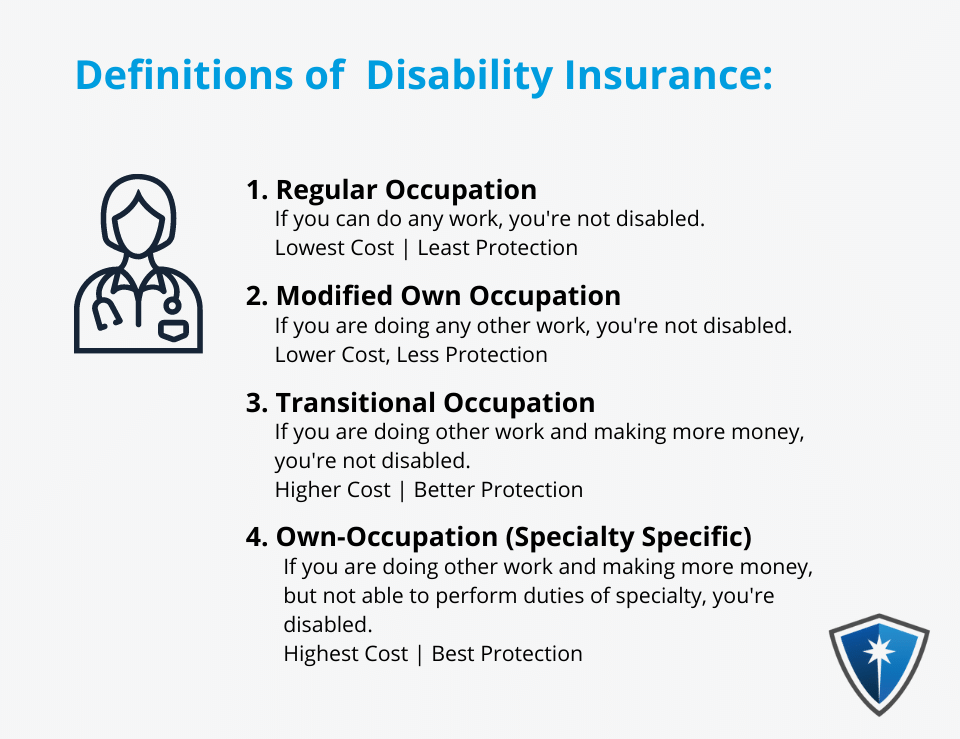

What are the different disability insurance definitions?

Regular Occupation

A good disability insurance policy for a doctor will be occupation-specific. Doctors have unique skills and abilities, and they depend on that knowledge to do their job properly. Cognitive disabilities are certainly a consideration, but you should also think about physical disabilities as well. For example, if a surgeon loses their index finger in an accident, that will significantly affect their job—it might not affect someone else as much if they drive a truck or a forklift.

A policy that covers your "regular occupation" will address any disability that inhibits your ability to continue to work in the medical field. However, it will not address specialty-specific disabilities; those are covered in "own occupation, specialty-specific" policies. In more restrictive policies ("any occupation"), they might require that you cannot work at all in any occupation or field. However, the most beneficial policy for a doctor is going to be one that focuses on that specific occupation.

For example, a "regular occupation" policy might also pay benefits if you can continue to work in another field, such as if you have to go down a completely different career path because of your disability. Keep in mind that some policies start out in "own occupation," but then they transition to "any occupation" after a specified number of years. If you get this type of policy, you should be aware of this transition and plan accordingly.

Modified Own-Occupation

This policy will cover a disability that occurs and keeps you from working in your own occupation. However, there is an additional caveat—you also are not working in another field. This policy does not require you to be unable to work, but you are not allowed to work and get benefits at the same time.

In "regular occupation" policies, you can work outside your field and still get benefits. A "modified own-occupation" policy requires that you cannot work in another field at all to receive benefits.

Transitional Own Occupation

Own Occupation Specialty Specific

Disability Policy Exclusions and Limitations

Every disability insurance policy for doctors has its own limits and exclusions. Therefore, you should review the policy carefully to determine what exclusions are included in the policy. While exclusions can reduce the premium you pay on the policy, they can also significantly limit coverage.

Some of the most important exclusions and limitations that physicians should consider are set out below.

Medical Conditions (Pre-existing)

Many policies will not cover pre-existing medical conditions. If you have a known and treated medical condition before you got the policy, there is a good chance that your benefits will be limited as to that particular condition.

To be "pre-existing," a condition must have occurred within a lookback period or waiting period. These periods vary, but they can be as long as a year. In general, if there are any medical records that reference the condition or provide treatment, it will be considered "pre-existing."

Mental Disorders

Some policies do not cover mental disorders; they only provide coverage for physical limitations. Examples of conditions that might fall under this exclusion include:

- Depression

- Anxiety

- Stress

If the policy provides coverage for mental disorders, the benefit period might be limited to a shorter period of time compared to physical disabilities.

Substance Abuse

Xtreme Sports

Act of War

Active Military

Normal Pregnancy

Foreign Travel

Mental/Nervous Disorder

Disability Policy Features and Riders

Residual Disability Rider

Inflation Protection Rider

This rider is just like it sounds—the amount of benefit will increase to keep up with inflation. It is sometimes referred to as the "Cost of Living" or "COLA" rider. This provision is especially helpful if you purchase your policy at a young age, but you are not disabled until years down the road.

Most inflation options are a fixed amount like 3% or 5% and increase annually once benefits start.

Future Purchase Option

Non-Cancelable and Guaranteed Renewable Rider

Graded vs. Level Premiums

Elimination Period

Group Disability vs. Individually Owned Disability

Definition Differences

An employer generally offers group policies, but for doctors, these benefits and policy features are limiting. Group policies are usually less expensive, but their coverage might not be as extensive.

In most cases, an independent policy will have a broader definition of disability, but they are usually more expensive.

Portable (Can you take it with you?)

Social Security Disability Benefits

Social Security Disability (SSD) can provide some coverage for disabilities. The amount of benefit you can receive will vary based on how long you have been working and how much you earned while working. As a rule, you have to contribute to Social Security for at least 20 quarters over the last ten years, but there are some exceptions.

In most cases, the amount of SSD you will earn as a doctor is not going to be nearly as much as what you were earning while working full time. You cannot rely on SSD to replace your income in the same way that you can from private disability insurance. At most, it could supplement your benefits from private disability insurance.

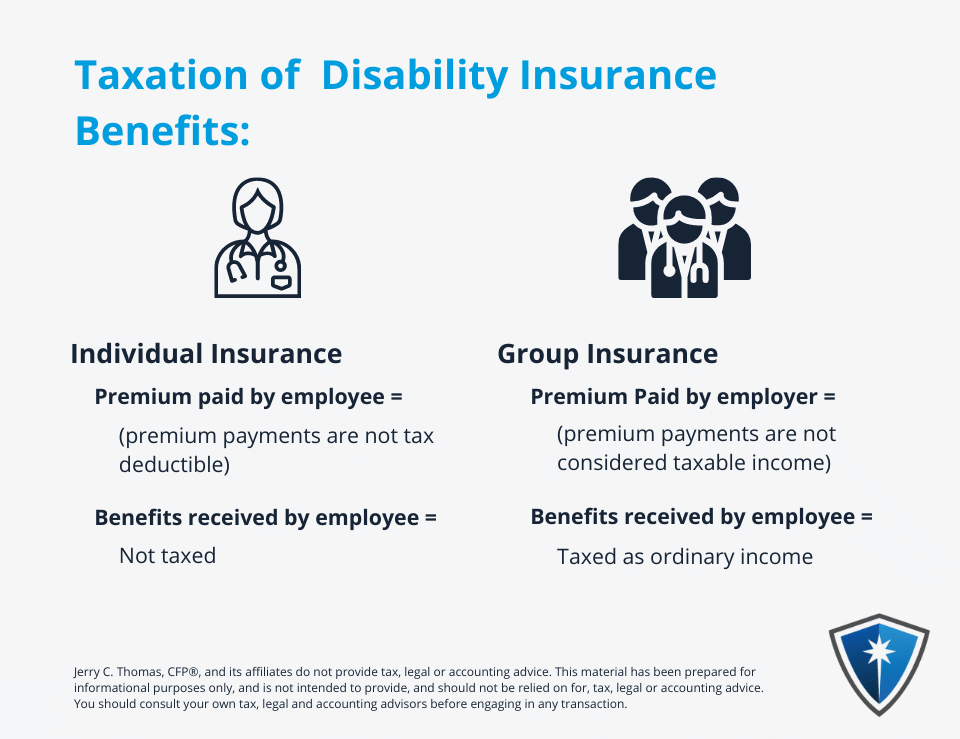

How do taxes affect disability insurance?

Group Policy

Individual Policy

How much disability insurance do I need?

Ultimately, how much disability coverage you need is up to you. However, as a rule for doctors, it is a good idea to get enough coverage that you can cover your living expenses and retirement savings until the age of 65.

Keep in mind that this number is not necessarily the same as your total income—it is costs plus retirement. You can reduce the amount of benefit you need by scaling back your lifestyle in many cases.

Most policies will pay out about two-thirds of your income. However, you can sometimes get more than one policy to increase the benefit amount. As a rule, resident physicians will usually get around a $5,000/month policy, while attending physicians will often get a $10,000 to $15,000/month benefit. The benefits you need might be within or outside of these general guidelines.

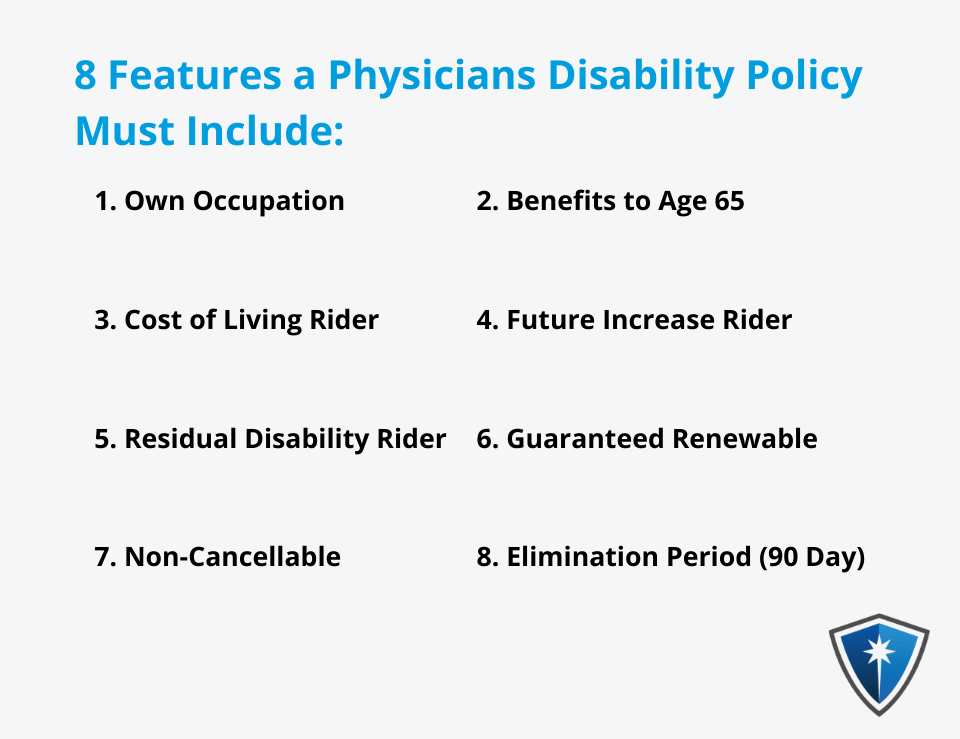

What features do most physicians purchase on their policy?

Own Occupation

Most doctors will get "own occupation" disability insurance coverage. You will recall that this policy will pay benefits if you cannot work in your occupation or specialty, even if you can work in another field.

In general, "own occupation" coverage will apply to whatever work you are doing at the time you become disabled. That means that if you are a specialist in a particular field, it will apply to your specialty occupation.

Benefits paid to Age 65

Cost of Living Adjustment

Future Increase Rider

Residual Disability

How much does disability insurance cost?

The short answer is—it depends. The type of policy you have and personal health factors will all play a role in determining how much disability insurance might cost. Compared to other types of coverage, like umbrella or term life insurance, disability insurance for physicians can be pricey. The extra expense is simply in response to the fact that it is far more likely that you become disabled compared to passing away during your working years.

As a rule of thumb, a health doctor in her 20s or 30s can expect to pay somewhere between 2% and 6% of the total monthly benefit. However, many other factors affect premium costs.

What factors determine your disability insurance price?

Age

Gender

Current Health

Medical Sub-Specialty

Benefit Amount

Length of Benefits

Elimination Period

What discounts are available for physician disability insurance?

Unisex Discounts

Multi-Life Discounts

Institution Discounts

Association Discounts

What is the application and underwriting process?

You must apply for disability insurance benefits. The underwriting process involves reviewing your application to determine the final terms and conditions of your specific policy based on the information you provided in your application.

In general, you can expect the application and unwriting process to involve the following steps: